USD/JPY flirting with highs near 114.60

The greenback is extending its march north on Wednesday, pushing USD/JPY to the area of daily highs near 114.60.

USD/JPY focus on US data, Yellen

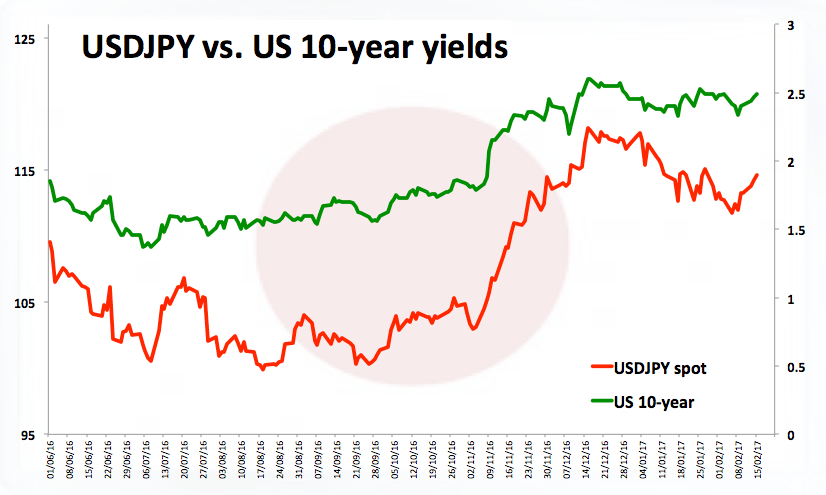

The pair remains on a firm fashion so far this week, navigating in fresh 2-week peaks around 114.60 and always backed by the solid momentum surrounding the buck via a strong rebound in US yields.

The hawkish tone from J.Yellen at the Humphrey Hawkins Testimony on Tuesday gave extra legs to the Dollar’s rally, opening the door for a rate hike at the March meeting as well as reinforcing the gradual path of the future rate hikes.

USD picked up extra pace after Yellen argued that it would be ‘unwise’ to wait too long to hike rates, while Richmond Fed J.Lacker hinted at the possibility of more than three rate hikes this year.

Spot will remain under scrutiny in light of the upcoming second testimony by Chief Yellen before the House Financial Services Committee. In addition, US inflation figures gauged by the CPI, Industrial Production, TIC Flows, the Empire State index, January’s Retail Sales and the NAHB index are all due.

Further events include speeches by Boston Fed E.Rosengren (2019 voter, dovish) and Philly Fed P.Harker (voter, hawkish).

USD/JPY levels to consider

As of writing the pair is advancing 0.27% at 114.57 and a breakout of 115.03 (55-day sma) would open the door to 115.39 (high Jan.27) and finally 115.62 (high Jan.19). On the other hand, the next support lines up at 113.47 (20-day sma) followed by 113.21 (low Feb.14) and then 112.84 (low Feb.10).