Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

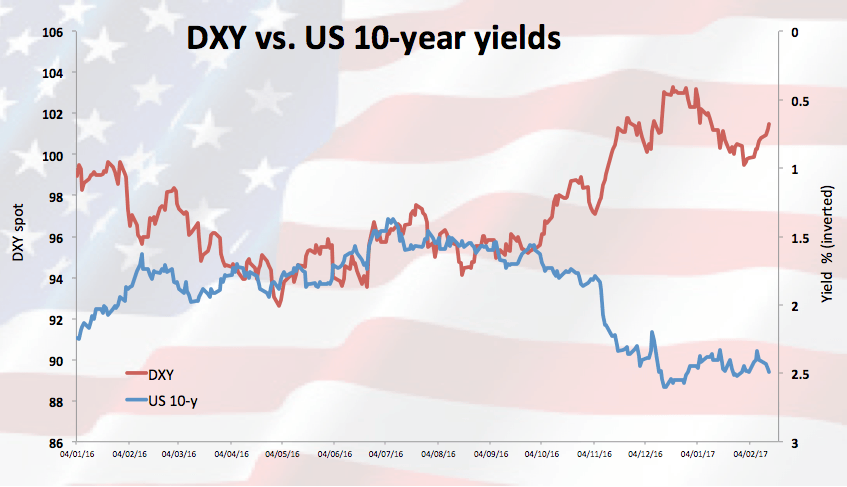

The US Dollar Index (DXY) – which tracks the buck vs. its main rivals – has extended its upside momentum further north of the key 101.00 barrier following the hawkish message by Chairwoman Janet Yellen at her semi annual Humphrey Hawkins Testimony on Tuesday.

Yellen suggested it would be ‘unwise’ to wait too long to hike rates, advocating at the same time for a gradual pace of rate hikes. Her comments were supported further by Richmond Fed J.Lacker, who slipped the chance that the Fed may need to raise rates more than the initially projected three times this year.

USD remains well underpinned by the performance of yields in the US money markets, where the 10-year benchmark briefly tested the key 2.50% area yesterday, extending the rebound from last week’s troughs around 2.32%.

According to CME Group’s FedWatch tool, the probability of a rate hike at the March meeting has climbed to nearly 18% from just above 13%, although it could keep climbing in case today’s key releases in the US docket add to the already healthy US fundamentals. Yellen’s second testimony today is not expected to steer away from the recent tone, leaving scarce room for surprises.

In the meantime, the long-term underlying bullish stance on DXY remains well supported by the divergence in monetary policy between the Federal Reserve and its peers. In the shorter run, however, US politics should add more volatility around the buck as uncertainties around the potential economic measures by the Trump’s administration remain high.