Wall Street: worse week since January 2016 as US-China trade war escalates

- China said they will put tariffs on 128 US products.

- The three main indices saw dramatic moves down this week.

Wall Street Indices continued to tumble this Friday as Trump imposes tariffs on 50 billion worth of Chinese goods. The S&P 500, the Dow Jones and the Nasdaq had their worst week since January 2016

The S&P 500 Index dropped 1.85% after yesterday’s loss of 2.5% which was the biggest loss in six weeks. The Dow Jones Industrial Average lost 510 points or 2.12% while yesterday it lost more than 700 points as worried investors were anxious to dump stocks in favor of the safety of Treasury bonds and the Japanese yen which has broken an important support at 105.50 on the USD/JPY pair.

This week the Dow plunged 5.7% and the S&P 500 plummeted 5.9%, while the NASDAQ dropped 6.5%.

“Tariffs mean a trade war and the news has the world’s investors running for the exits,” says Chris Rupkey from MUFG Union Bank.

In response to US tariffs, China's commerce ministry proposed a list of 128 US products as potential retaliation targets. China said it will take measures against the 128 US goods in two stages if it cannot reach an agreement with Trump. China could also take legal action under World Trade Organization rules.

The technology sector is also at risk as China is going to retaliate to the tariffs by more tariff on US goods. Facebook continued sinking losing almost 4% on Friday alone and down nearly 20% from its high at $195 made in 2018 as Cambridge Analytica gathered data from 50 million Facebook profiles without asking its users.

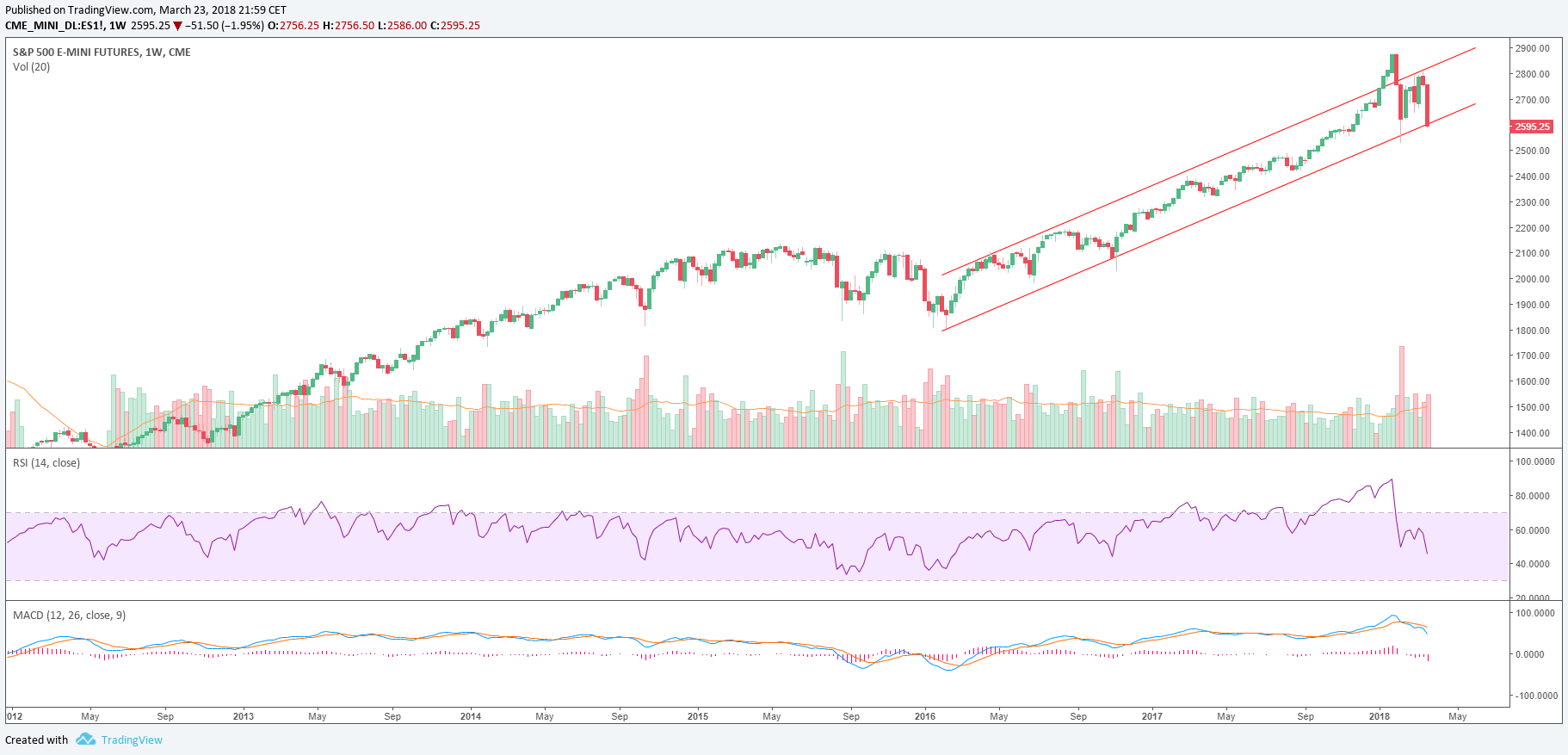

S&P 500 Index weekly chart

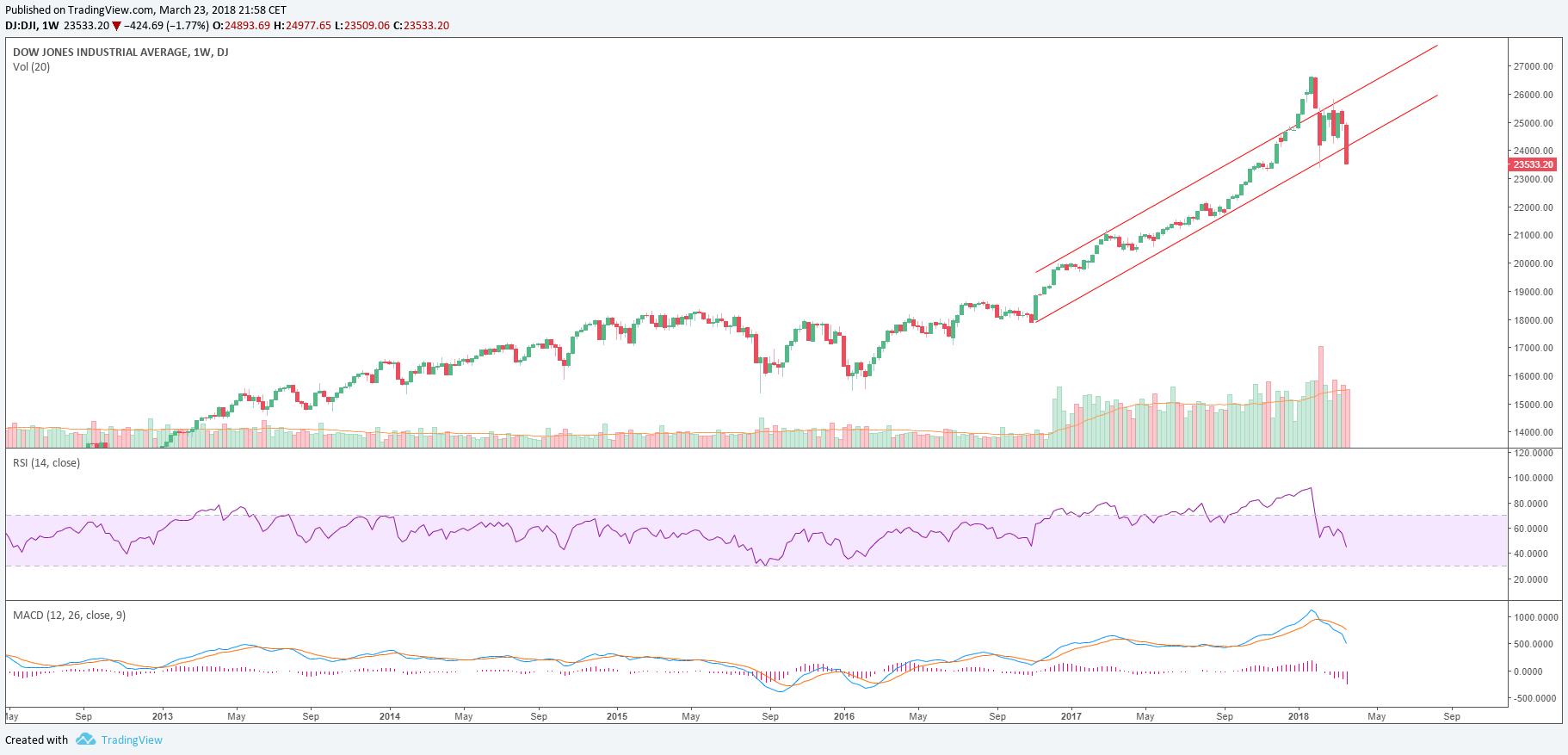

Dow Jones Index weekly chart

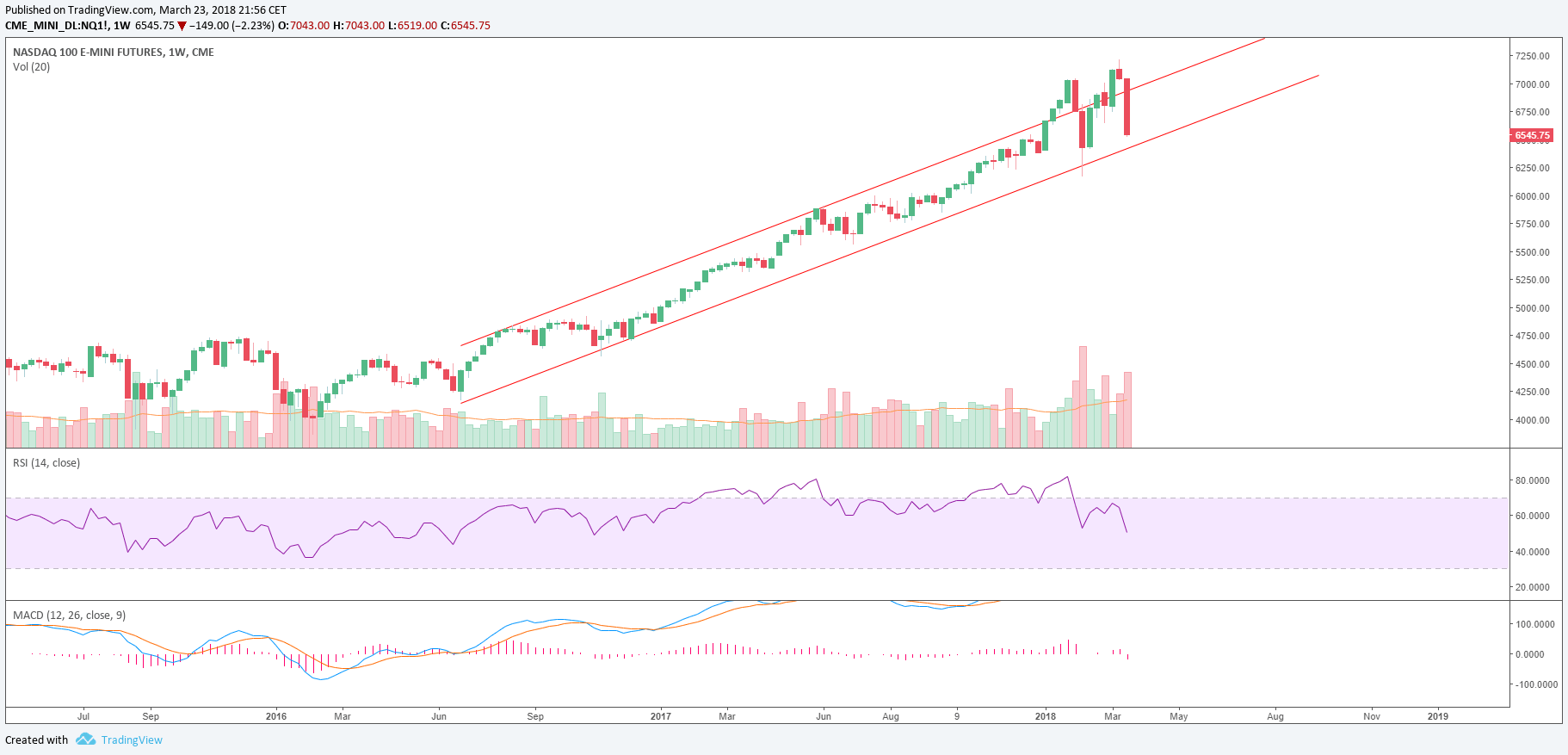

Nasdaq weekly chart