EUR/USD keeps the 1.2350-1.2400 range intact ahead of Fed speech

-

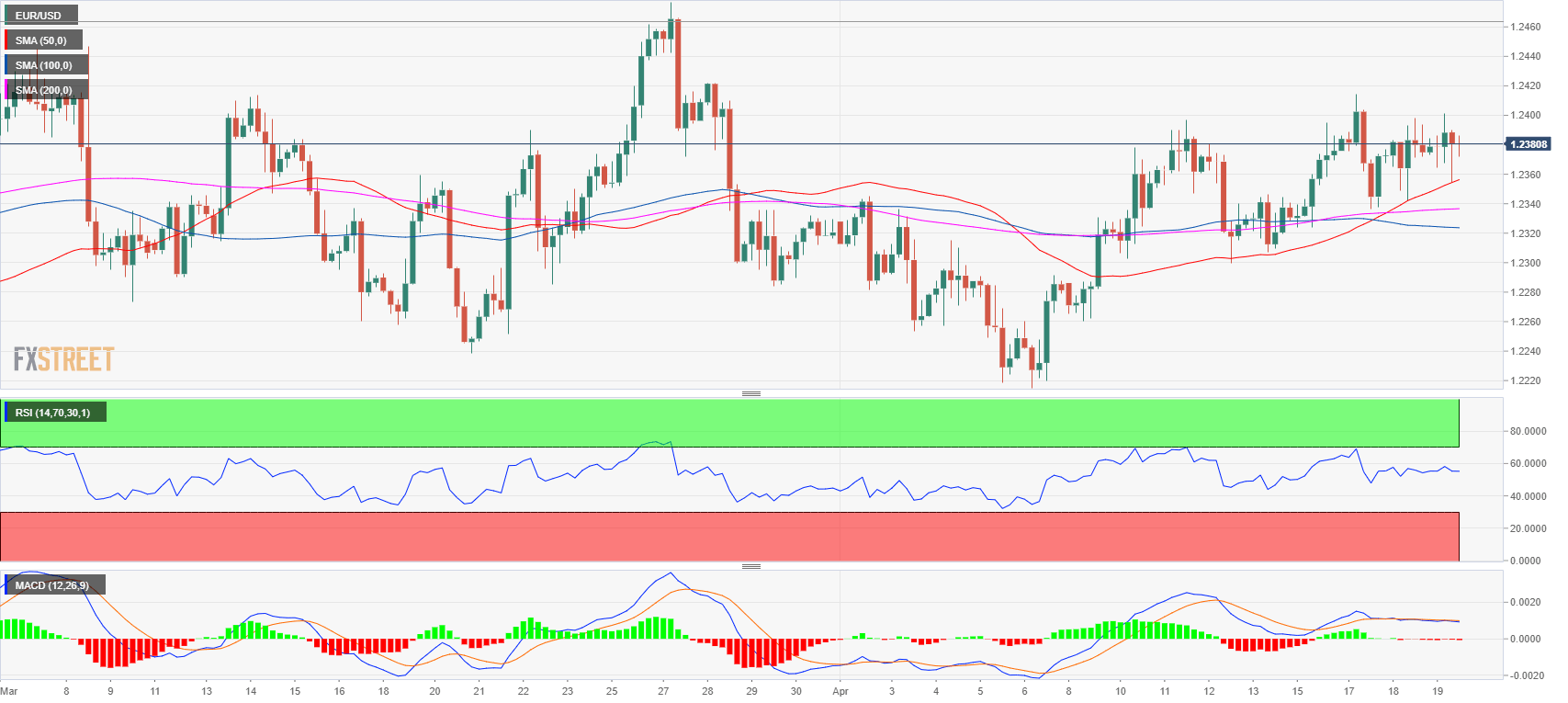

Amid lack of market-moving data, the EUR/USD is mainly driven by technical moves in a tight 50-pip range.

-

Coming up next on the US calendar, Feds Quarles testimony before the Senate Banking Committee is slated at 13:30 GMT.

The EUR/USD is trading at around 1.2380 virtually unchanged on Thursday in the early North American session.

Freshly released, the weekly US job numbers disappointed while the Philadephia Fed Manufacturing Survey for April came above expectation with no major reaction on the EUR/USD.

Coming up next, Governor Randal Quarles, the Federal Reserve Vice Chairman for Supervision, will deliver his semi-annual testimony before the Senate Banking Committee at 13:30 GMT.

Earlier in Europe, the single currency tested yet again the 1.2400 resistance level which has been capping further advances since April 11. The bull attempt was met by strong selling interest and the pair fell back down to the 1.2355 level which was soon brought back buy bulls; and the range stays intact until one side gives up.

On the broader picture, the US Dollar Index (DXY) is still stuck in the 89.50-89.60 range and although it strongly rebounded on early Tuesday’s trading it is still struggling to build any convincing momentum to the upside. US stocks are currently slightly correcting their impressive advance of the last few days and gold is trading sub-$1,350 a troy ounce.

EUR/USD 4-hour chart

The pair is currently in a bull leg since April 6 and the increasing lack of momentum and range trading between the 1.2350 support and 1.2400 resistance level makes investors wonder if the bull move is still in effect or if a reversal down towards 1.2200 support is in the making.