GBP/USD Technical Analysis: Fades an intraday bullish spike, slides closer to 1.3100 handle

- GBP/USD rebounds from a two-week-old ascending trend-line support.

- No-deal Brexit seemed to keep a lid on any strong gains, at least for now.

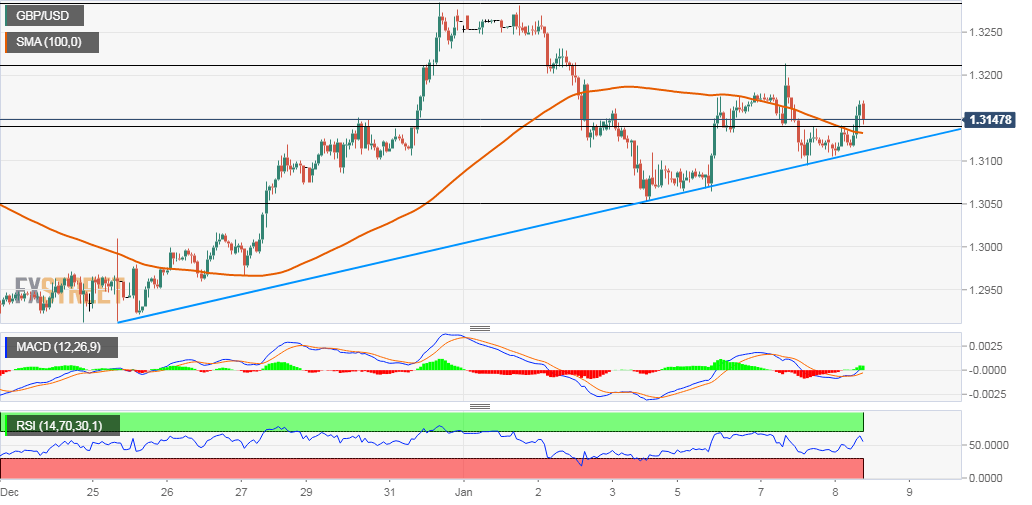

The GBP/USD pair managed to find some support near a two-week-old ascending trend-line and regained positive traction on Wednesday. The intraday uptick lifted the pair back above 100-hour SMA and 38.2% Fibonacci level of the 1.3515-1.2905 recent pullback.

The pair climbed to fresh session tops, around the 1.3170 region in the last hour, albeit failed to capitalize on the momentum and quickly retreated few pips thereafter. Concerns that the UK might crash out of the EU seemed to be one of the key factors capping the upside.

Meanwhile, mildly positive oscillators on hourly/daily charts support prospects for some additional gains. However, bulls seemed to refrain from placing aggressive bets ahead of a key meeting between the UK PM Johnson, the EU Commission President Ursula von der Leyen and the EU's chief Brexit negotiator Michel Barnier.

Hence, it will be prudent to wait for some strong follow-through buying above the 1.3200-1.3210 region (50% Fibo.) before positioning for a move back towards mid-1.3200s en-route the recent swing high resistance near the 1.3285 region.

On the flip side, the mentioned trend-line, currently near the 1.3110-1.3100 region, might continue to protect the immediate downside, which if broken now seems to accelerate the slide further towards the 23.6% Fibo. level support near the 1.3055-50 region.

Some follow-through selling has the potential to continue exerting some pressure and turn the pair vulnerable to drop further towards testing levels below the key 1.30 psychological mark.

GBP/USD 1-hourly chart