AUD/JPY Price Analysis: Registers another pullback from key SMAs

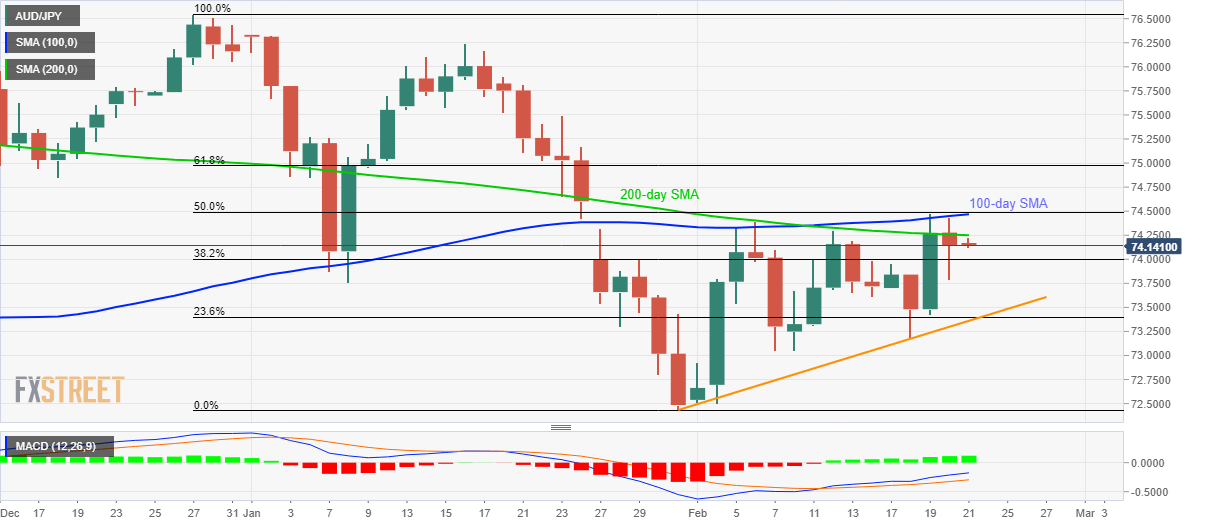

- AUD/JPY remains on the back foot after failing to cross important resistances.

- 38.2% Fibonacci retracement acts as the immediate support, the monthly rising trend line is the key.

- 61.8% Fibonacci retracement can please the bulls during an upside break.

AUD/JPY declines to 71.14 during the Asian session on Friday. The pair recently reversed from 100-day and 200-day SMA while also taking a U-turn from 50% Fibonacci retracement of its declines from December 2019 to January 2020.

Given the repetition of the early-month pattern, AUD/JPY prices are likely to drop further towards 38.2% Fibonacci retracement level of 74.00 and then to 73.60 immediate rest-points.

However, an upward sloping trend line since January 31, as well as 23.6% Fibonacci retracement, around 73.40/35, will be the key support to watch.

Meanwhile, a 200-day SMA level of 74.25 can act as nearby resistance ahead of the confluence of 100-day SMA and 50% Fibonacci retracement close to 74.50.

If at all the quote manages to remain strong beyond 74.50, 61.8% Fibonacci retracement near 75.00 will be on the bulls’ radars.

AUD/JPY daily chart

Trend: Bearish