Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

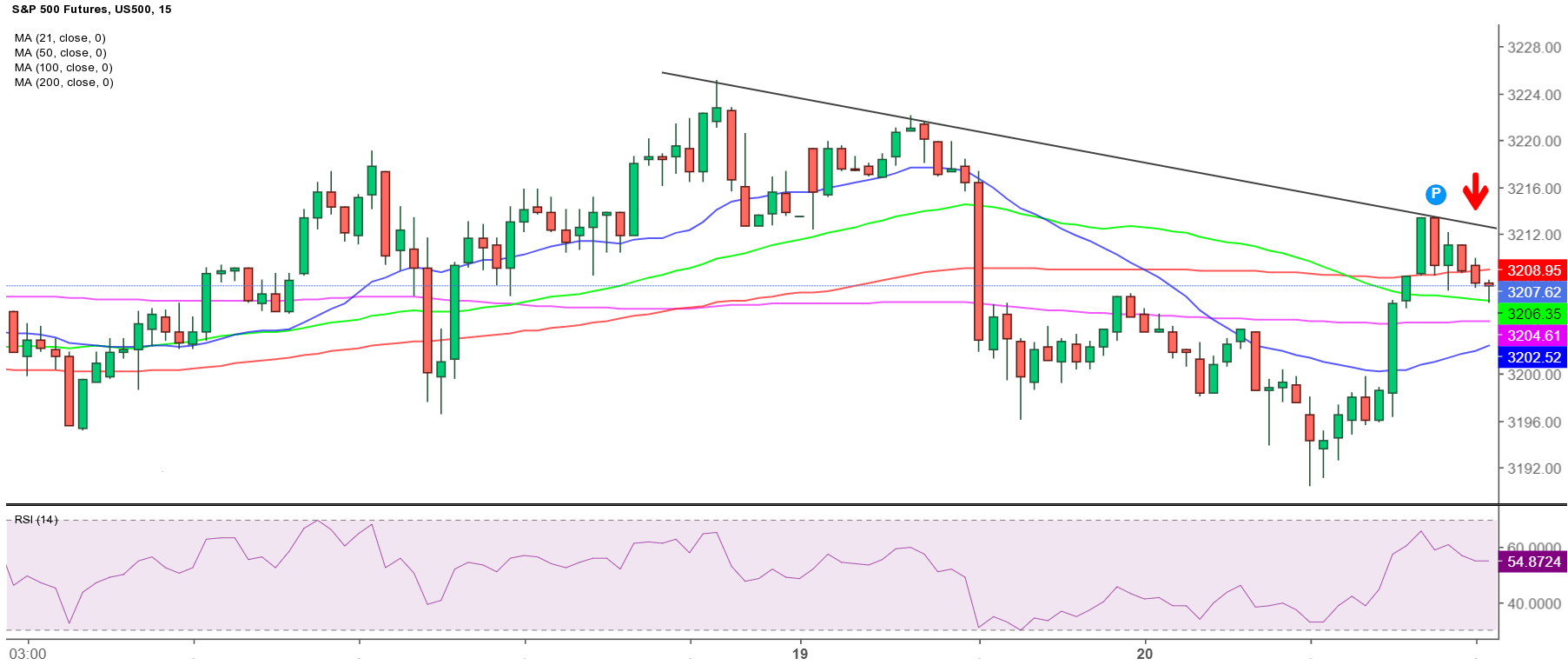

S&P 500 futures, the risk barometer, post small losses in mid-Europe, as the recovery momentum fizzled out amid looming risks from the continued spread of the coronavirus globally.

From a technical perspective, the price looks vulnerable and could resume the recent downtrend, having faced rejection at the falling trendline resistance on a few occasions over the last hour.

The US futures has breached the horizontal 100-Simple Moving Average (SMA) support on the 15-minutes chart, aligned at 3209 and now challenges the bearish 50-SMA at 3206.

The 15-minutes Relative Strength Index (RSI) has turned south and looks to pierce the 50 midline from above. This suggests that bearish bias will likely persist in the coming hours.

Therefore, the next downside target at the horizontal 200 15-minutes SMA at 3204.50 will be put to test, as the sellers eye the 3200 figure.

The buyers, however, remain hopeful as the price still holds above the 21-SMA at 3202.50.

Alternatively, only a convincing break above the falling trendline resistance, now at 3213 will revive the recovery momentum in the S&P 500 futures.

Further north, Friday’s high of 3225.25 could guard the near-term upside.