Forex Today: Dollar retreats after auction, gold rising amid fiscal impasse, focus on jobless claims

Here is what you need to know on Thursday, August 13:

The US dollar is on the back foot after the large bond auction and as optimism prevails in markets despite the fiscal impasse in Washington. Sino-American tensions and a US-EU are eyed ahead of weekly jobless claims.

Investors are pushing bond yields down once again – after a record $38 billion auction. In turn, the pendulum is swinging against the greenback after it rose earlier in the week. Another factor weighing on the world's reserve currency is market optimism about achieving a vaccine. The upbeat mood is diminishing demand for the safe-haven dollar.

The S&P 500 Index briefly topped the previous all-time high recorded in mid-February. Robust earnings from tech firms have underpinned the gains, in addition to hopes for a recovery.

Gold is holding onto its recovery, trading around $1,930. It shed $200 earlier in the week and is now rising with other assets.

See Gold Price Analysis: $1907 is the last straw for the XAU/USD bulls – Confluence Detector

At the same time, Democrats and Republicans remain far apart on the next fiscal stimulus package, as described by both sides. The longer the impasse continues, the more significant the damage to the world's largest economy.

Officials at the Federal Reserve have urged lawmakers to act and provide support. The list includes Mary Daly, Robert Kaplan, and most vocally, Eric Rosengren, President of the Boston branch of the Federal Reserve. who said this is an appropriate time to take strong fiscal actions.

After inflation figures beat estimates in July, the focus shifts to weekly jobless claims, which are projected to remain around 1.1 million.

See Jobless Claims Preview: If higher claims are evidence of an economic slowdown are lower a sign of an acceleration?

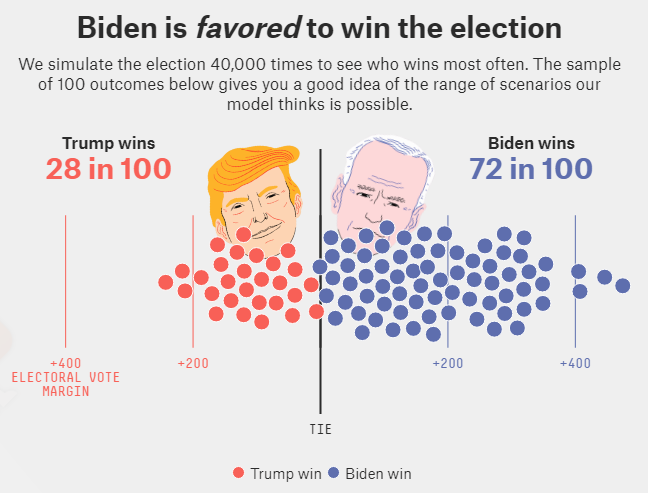

The US electoral campaign heats up after Democratic Challenger Joe Biden made his first appearance with Senator Kamala Harris, his running mate. The highly regarded election forecast by FiveThirtyEight has been published and it shows Biden leading over President Donald Trump, albeit with a high level of uncertainty at this point.

Source: FiveThirtyEight

Sino-American tensions remain elevated ahead of a trade review by the world's largest economies. China aims to put America's sanctions on TikTok and WeChat on the table. Washington slapped tariffs Berlin and Paris, related to the long-running dispute around Airbus.

AUD/USD is on the rise amid robust employment figures – Australia gained 114,700 jobs in July and the unemployment rate fell to 7.5%.

NZD/USD is on the back foot after Young Ha, the Reserve Bank of New Zealand's Chief Economist, said that his institution would like a weaker kiwi. The nation reported 14 additional coronavirus cases with Auckland, the largest city, remaining under lockdown.

Oil prices are holding onto high ground with WTI trading near $43. USD/CAD is changing hands below 1.33.

Cryptocurrencies have stabilized, with Bitcoin trading around $11,500.

More Traders are looking at the shiny thing and not the big picture