USD/IDR Price News: Rupiah refreshes monthly high above $14,400 as Indonesia eyes fiscal deficit cut

- USD/IDR wobbles around the lowest since March 29.

- Indonesia Finance Ministry conveys plans to cut budget deficit to 5% in 2022, under 3% in 2023.

- US dollar stays offered, helps the pair bears despite covid woes at home.

USD/IDR remains depressed around the late March low, down 0.18% intraday near $14,450, while heading into Thursday’s European session. The pair recently eased on hopes of an upbeat Indonesian economy going forward and the US dollar weakness. However, the key support comprising the key SMAs challenges the pair’s further downside.

As per the latest comments from Indonesia Finance Ministry Official Febrio Kacaribu, recently published by Reuters, Southeast Asia’s biggest economy, “plans to reduce its budget deficit next year to less than 5% of gross domestic product and under 3% in 2023 as part of post-crisis fiscal consolidation measures.” The official further said, “Last year's deficit of 6.1% was the biggest in decades and the government expects a 5.7% gap this year.”

Reuters also mentioned that Economists have warned Indonesian policymakers that withdrawing pandemic-era stimulus too soon could disrupt an economic recovery, but Finance Minister Sri Mulyani Indrawati has stuck to her tapering plans, which she has said was important to maintain policy credibility.

On the contrary, the US dollar index (DXY) dropped to the lowest in two months before recently bounding off to 90.54, down 0.07% intraday, as markets cheer hopes of more stimulus from the US government and continuation of easy money policies by the Federal Reserve (Fed).

Amid these plays, stocks in Asia-Pacific stay mildly bid while the US 10-year Treasury yields wobble around 1.61% by the press time.

Looking forward, preliminary readings of the US Q1 GDP becomes the key as any further rising of the economic growth will join the strong inflation expectations and can push the Fed to dial back the easy monetary policies.

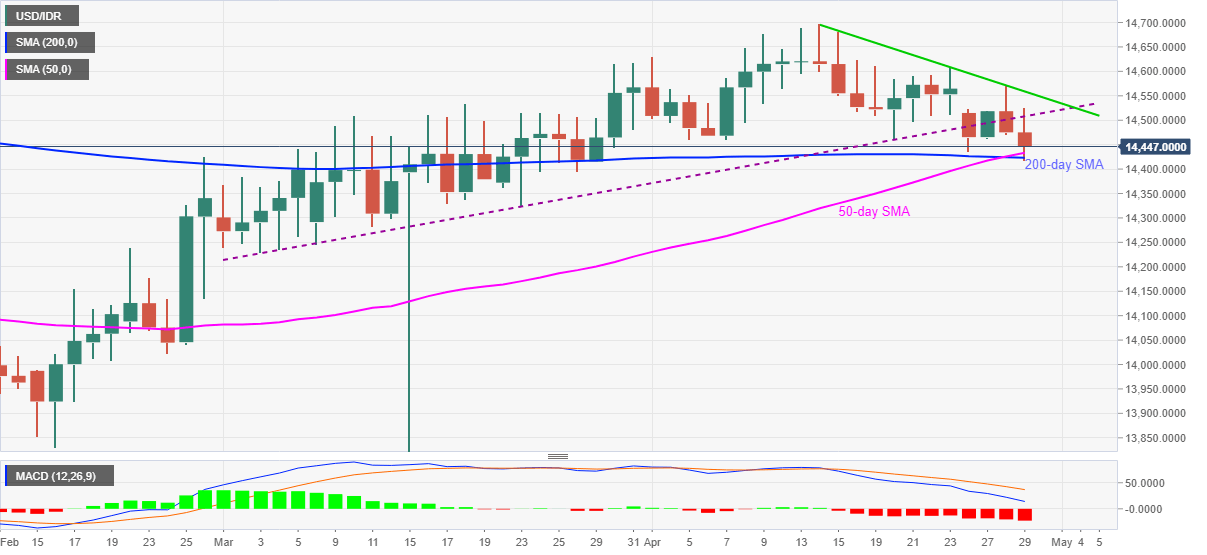

Technically, USD/IDR stays depressed between the seven-week-old support line, now resistance, as well as a confluence of 50-day and 200-day SMA. Hence, any decisive move beyond the $14,420-560 range will be the key to watch.

USD/IDR daily chart

Trend: Bearish