Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

Risk sentiment is firm and the US dollar is on the backfoot, giving the yellow metal room to breath above water following the prior day's rally. Investors are betting that the latest COVID variants will not disrupt global development and this has given the bulls on Wall Street the shot in the arm they needed at this time of year.

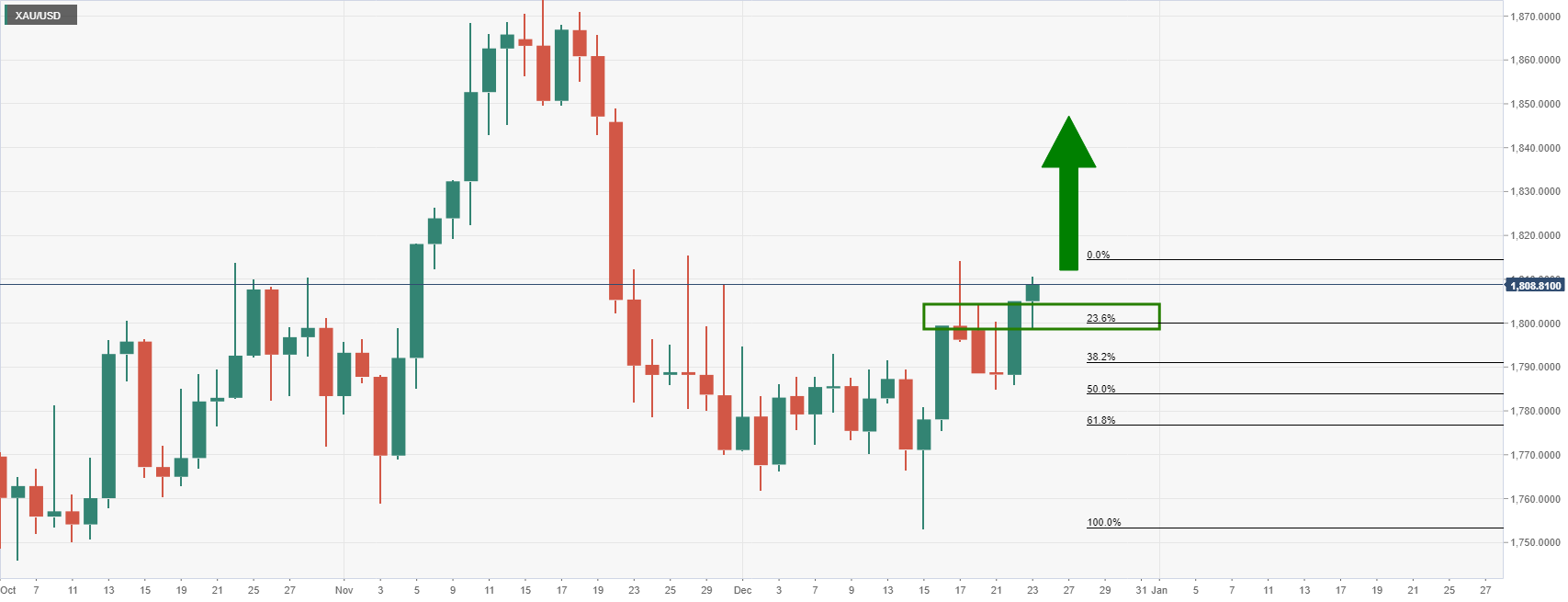

In turn, this has promoted a bid in gold despite regulators' concerns about the spread of the new variant, Omicron. At the time of writing, gold is trading at $1,809 and is higher by some 0.35% on the day so far after travelling from a low of $1,798.91 to a high of $1,810.74.

Looking around elsewhere on Wall Street, US stocks are on pace to close at new record highs, fuelled by more drug makers announcing that their COVID-19 preventives retained protection against the omicron variant. The S&P 500 rose 0.85% to 4737 the highs printed in the last hour of trade. The Nasdaq Composite advanced 0.97% to 16,343, and the Dow Jones Industrial Average gained 0.78% to print a high of 36,051 with still time to go until the close.

Meanwhile, the 10-year US Treasury yield rose to 2.47% on the last full day of trade in the bonds before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual).

The US dollar, as measured by the DXY index is losing ground as the day progresses into late trade in North America. The index is now down some 0.11% and has moved from a flat position that was otherwise maintained in earlier trade. DXY is currently trading at 96.017 and has breached the figure to score a low of 95.99 from a high of 96.277 within the sideways channel/daily wedge formation:

The recent covid-variant news is a breath of fresh air for investors that have otherwise been concerned by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

However, analysts at TD securities warn that ''the yellow metal could begin to lose steam so long as Fed expectations remain as status quo. In this sense, omicron fears and their potential impact on the economy will be a key focus in the near-term, and we would likely need to see economic weakness generate doubts that the Fed will be able to deliver on their hawkish stance for the yellow metal to maintain the recent momentum.''

''Indeed, prices will need to hold north of the $1,800/oz to prevent a hasty liquidation of a portion of the recently acquired length,'' analysts at TDS said.

Additionally, US data has shown that personal income and spending rose, with Consumer Sentiment improving and Jobless Claims keeping near recent lows.

The US Initial Jobless Claims totalled 205,000 during the week ended Dec. 18, in line with market expectations. Personal Consumption Expenditure Inflation rose 0.6% on a monthly basis in November and 5.7% annually, in line with market forecasts. However, excluding volatile food and energy costs, the measure was up 4.7% year-over-year, the most since 1989 which have helped to keep yield elevated and the US dollar supported.

Meanwhile, personal income rose 0.4% in November versus market expectations for a gain of 0.5%, while spending grew 0.6% in line with estimates. Lastly, the University of Michigan consumer sentiment index was revised up slightly Thursday to a reading of 70.6 for December from the 70.4 preliminary estimates.

Following the correction to $1,785. The bulls are embarking on an upside extension with $1,830/50 eyed.