Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

The Reserve Bank of Australia's Philip Lowe has stated that there is a ''big deviation between what we expect to do on rates and what markets expect.''

His comments during a testimony at a virtual hearing before the House of Representatives Standing Committee on Economics are being scrutinised for an insight as to when the RBA will start to raise rates.

However, in earlier comments, he said that it is ''plausible we could raise rates later this year depending on the economy.''

He added that he hasn't said rates won't go up.

His testimony comes shortly after very hawkish rhetoric from a voting member of the Federal Open Market Committee, James Bullard, who said that the Fed could consider hiking rates at an Inter-meeting.

Traders are treading very carefully around the sentiment in markets but do expect the RBA to follow suit sooner than previously communicated by the central bank.

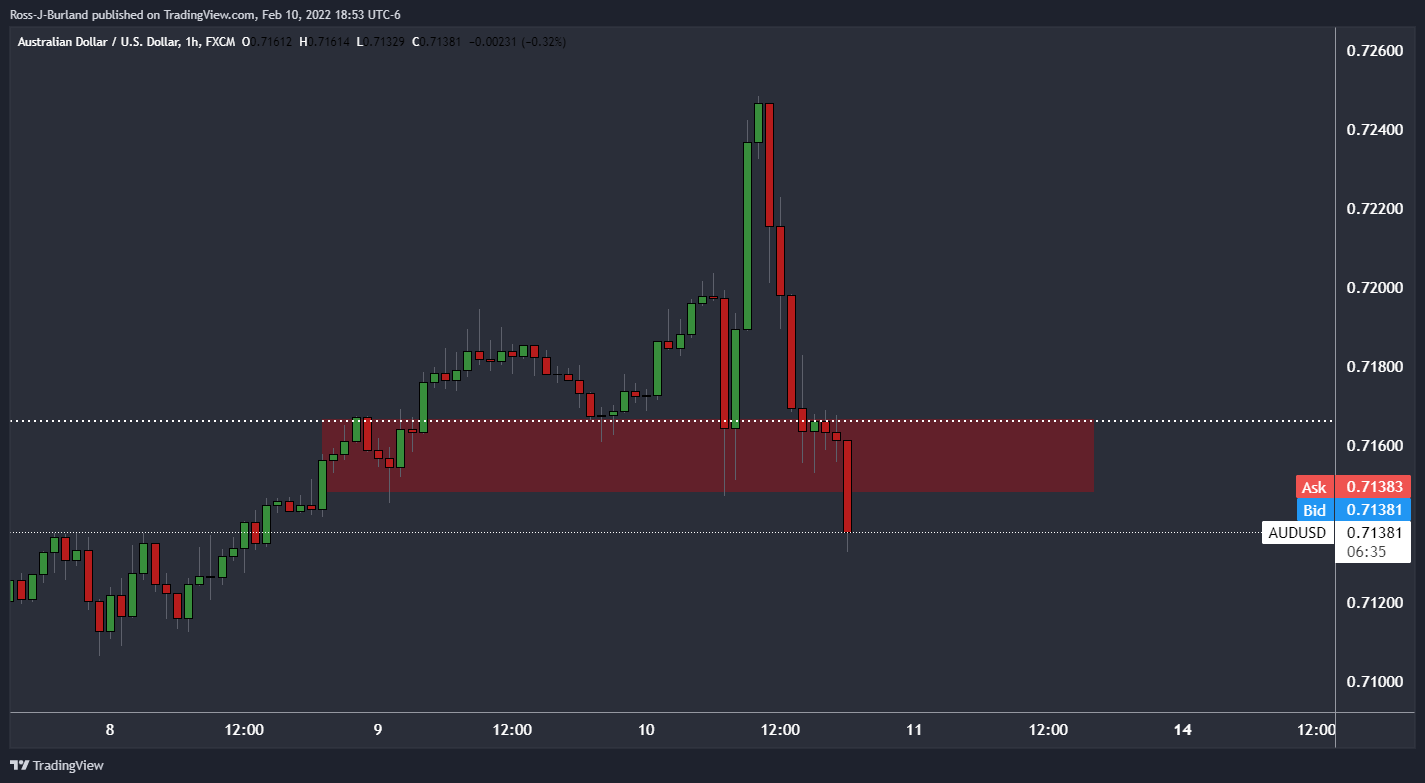

At the time of writing, the US dollar is bid and the Aussie is under pressure, falling below a key area of support, support highlighted in the prior analysis as follows:

The prior support would now be expected to act as resistance on restest and that could lead to further supply before the week is out.